[Johannesburg, 8 September 2025] – Sun International delivered a solid performance for the six months ended 30 June 2025, navigating macroeconomic headwinds and structural shifts in the gaming sector. The results underscore the strength of the group’s diversified portfolio and its increasing focus on an omnichannel approach.

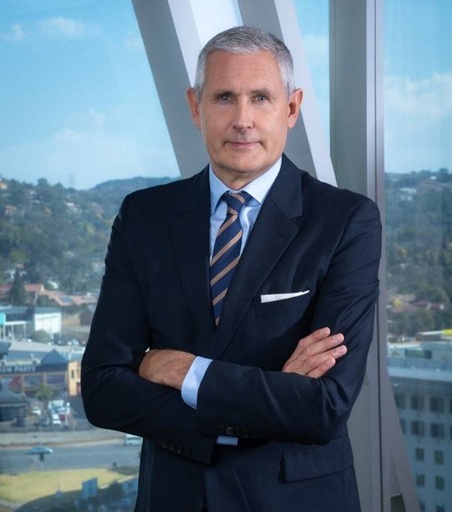

New Chief Executive, Ulrik Bengtsson, takes over a well-capitalised and diverse business, whose market-leading assets include land-based casinos, online gaming, resorts and hotels, and limited payout machines.

“I am delighted to have joined Sun International at such a pivotal time. Overall, the group has an excellent collection of assets, and all four business portfolios have their own set of clear opportunities. I look forward to working with teams across the businesses to position the group for its next phase of growth,” remarked Bengtsson.

The group's continuing income increased by 3.2% to R6.2 billion (including the Table Bay Hotel) compared to the six months ended 30 June 2024. Excluding the impact of the Table Bay Hotel (“TBH“) lease cessation, group continuing income increased by 6.7%. Group continuing adjusted EBITDA declined by 3.8% to R1.6 billion. Excluding the impact of the TBH lease cessation, group continuing adjusted EBITDA rose by 1.1%. The group’s adjusted headline earnings grew by 5.9% to R555 million, translating to adjusted headline earnings of 229 cents per share, a 6.5% increase over the prior period.

Image: Chief Executive, Ulrik Bengtsson Sun International

The Sunbet group maintained its upward trend, with income increasing by 70.7%, driven by increased volume of activity and deposits. The urban casinos had a muted performance with income declining by 1.4%. Some operational challenges in combination with a casino market that is under pressure will require the group to re-assess their approach to this business segment. Excluding the TBH, resorts and hotels revenue was up 4.3% to R1.3 billion on the prior period, driven by the recovery of conferencing and events. The Sun Slots strategy bore positive outcomes with income improving by 2.2% to R701 million compared to the prior period.

The Table Bay Hotel is undergoing a substantial refurbishment and will re-open in December 2025 as The InterContinental Table Bay Hotel, Cape Town. The hotel will be managed by Sun International under a hotel management agreement.

The group has consistently demonstrated its capability to generate significant cash flow through its diverse portfolio and is in a strong financial position with debt (excluding IFRS 16 lease liabilities) at R5.0 billion, down from R5.2 billion at 31 December 2024. The debt levels take into account the payment of the 2024 final net dividend of R591 million. Net interest cost decreased by 15.1% from the prior period as a result of the lower debt and interest rates.

Aligned with its stated dividend guidance of distributing 75% of adjusted headline earnings per share, the board has declared an interim gross cash dividend of 172 cents per share, amounting to R444 million. This dividend reflects a 6.8% increase over the prior period and underscores the group’s commitment to delivering sustainable value to its shareholders.

Urban casinos, which remain the cornerstone of Sun International’s land-based operations, reported income of R3.2 billion, representing a 1.4% decline. As the land-based casino market continues to be under pressure, the group is re-assessing its approach to this portfolio of businesses. The business delivered an adjusted EBITDA of R1.0 billion, pre-management fees, with a margin of 31.7%, down from 33.1% in the prior period.

The group has implemented a new operating model to position the urban casino portfolio as integrated entertainment destinations. Investment is being directed towards casino floor optimisation, service enhancements, product innovation, as well as improved marketing to better convert footfall. This, in combination with a sharpened focus on customer acquisition and retention strategies is expected to support income in the medium term.

The Sunbet group delivered another standout performance, with income up 70.7% over the prior period to R874 million. Income growth was primarily driven by a 128.7% increase in slots income, generated by increased customer activity and deposits.

The Sunbet group delivered an adjusted EBITDA of R292 million, pre-management fees, a substantial uplift from R166 million in the prior period, translating to an improved adjusted EBITDA margin of 33.4%. This margin expansion reflects operational leverage, disciplined cost management, and strong customer engagement across their products. Activity across all the product verticals has shown a strong increase over the prior period.

The group‘s limited payout machine business, Sun Slots, delivered adjusted EBITDA of R161 million, with a margin of 23.0% compared to 23.6% in the prior period. Sun Slots remains a strategic business in the group’s gaming portfolio. Sun Slots’ primary focus is to optimise its existing portfolio given its scale and the breadth and depth of its market offering by targeting the optimal sites in key regions and a coordinated rollout of Type-B licences.

The resorts and hotels sector in South Africa has experienced growth following a slow start to the year, driven by a resurgence in conferencing as the country hosts the G20 Summit and improved occupancy rates. The group’s rooms and food and beverage revenue, excluding the TBH, achieved good growth, with an increase of 9.9% on the prior period.

Excluding the TBH, adjusted EBITDA for resorts and hotels, pre-management fees, was R221 million, down 12.0% from R251 million in the prior period, resulting in an adjusted EBITDA margin of 16.8%, down from 19.9%.

Bengtsson remarked “Over the coming months we will re-assess our approach to both driving improvements in growth and optimising returns. My focus is on the long-term competitiveness of Sun International as a digitally-led, market-leading omnichannel gaming company of scale, enabled by competitive products, smart omnichannel solutions, engaged teams, and improved execution.

“Following the mutual decision not to proceed with the Peermont acquisition, the group benefits from a strong balance sheet which provides optionality around the deployment of our capital. We will look at our capital allocation policy to ensure that, in the future, we have the right balance between returns to shareholders, investment in the business, and value accretive M&A.

Sun International is a business with a diversified portfolio that has clear and distinct opportunities to drive growth. The group is well-positioned for sustainable growth, supported by the optimisation of urban casinos, strong momentum in digital conversion for Sunbet, selective expansion in Sun Slots, and the usual seasonal rebound in resorts and hotels. On an ongoing basis, we will continue to improve the infrastructure and casino offering and seek growth in selective regulated African markets for Sunbet, ” Bengtsson remarked.