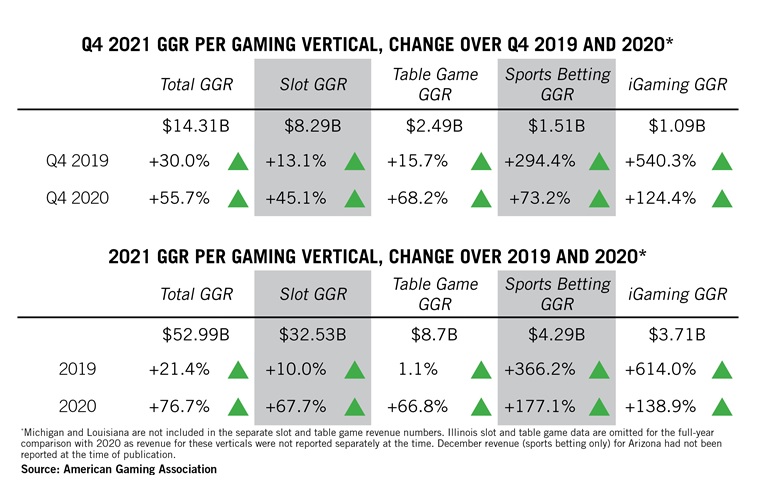

Washington, D.C. – 2021 set a new record as the highest-grossing year ever for the U.S. commercial gaming industry, reaching $53 billion in revenue, according to the American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker. The total breaks 2019’s previous industry record of $43.65 billion by more than 21 percent.

The industry closed the year on a high note, setting an all-time quarterly revenue record in Q4 2021 of $14.31 billion, surpassing the previous high-water mark of $13.93 billion set in Q3 2021.

“These results are nothing short of remarkable,” said AGA President and CEO Bill Miller. “The success of 2021 reflects our commitment to health and safety and how Americans have welcomed gaming’s expansion across the country. Today’s industry is effectively meeting customers how and where they want to engage—whether at a casino or through mobile gaming.”

Of the 34 operational commercial gaming jurisdictions in 2021—including four new markets—23 set individual records for full-year commercial gaming revenue. On a national level, every commercial gaming vertical set new annual revenue records.

Traditional brick-and-mortar gaming led the industry’s recovery, with 2021 combined slot and table gaming revenue totaling $44.94 billion, a 6.6 percent increase over 2019’s previous record.

Sports betting’s growth accelerated in 2021, generating $57.22 billion in handle and $4.29 billion in revenue—jumps of 165 percent and 177 percent over 2020 respectively. The sector’s all-time high was powered by strong demand in established markets like Nevada, New Jersey and Pennsylvania and further boosted by the launch of seven new commercial sports betting markets in Arizona, Connecticut, Louisiana, Maryland, South Dakota, Virginia and Wyoming.

Two new iGaming markets, Connecticut and Michigan, also opened in 2021, helping the sector to a record $3.71 billion in revenue. Combined sports betting and iGaming revenue for the year totaled $8.00 billion, up 158.0 percent from 2020 and accounting for a record 15.1 percent of annual industry gaming revenue.

“Despite our record-setting year, gaming’s total recovery is still reliant on the full return of travel and large events, which requires a safe health environment and open economy,” Miller continued. “I’m optimistic that we will see continued growth throughout 2022.”

Miller will make additional remarks on full-year 2021 commercial gaming revenue figures, reflect on gaming’s recovery and look toward AGA’s 2022 priorities in AGA’s annual State of the Industry webinar on Feb. 15 at 11:30 AM ET/8:30 AM PT.

Webinar Registration | Press Availability Registration

Background

- AGA’s Commercial Gaming Revenue Tracker provides state-by-state and cumulative insight into the U.S. commercial gaming industry’s financial performance based on state revenue reports. This issue highlights full-year 2021 figures and Q4 2021 results.

- 33 states and the District of Columbia featured operational commercial gaming markets in 2021, including casino gaming, sports betting and iGaming.

- Four new commercial gaming markets opened in 2021: Arizona, Connecticut, Virginia and Wyoming.

- AGA’s State of Play Map—newly updated for 2022—charts gaming’s economic impact, industry regulations and casino locations on a state-by-state basis for both the commercial and tribal gaming sectors.

About the AGA

The American Gaming Association (AGA) is the premier national trade group representing the $261 billion U.S. casino industry, which supports 1.8 million jobs nationwide. AGA members include commercial and tribal casino operators, suppliers, and other entities affiliated with the gaming industry. It is the mission of the AGA to achieve sound policies and regulations consistent with casino gaming’s modern appeal and vast economic contributions.