Record March Gaming Revenue Drives Industry’s Recovery

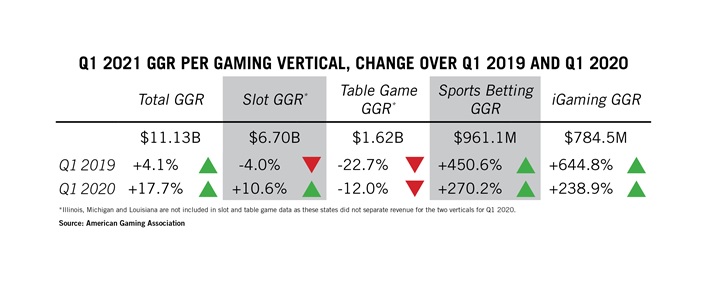

WASHINGTON – U.S. commercial gaming revenue topped $11 billion in Q1 2021, matching Q3 2019 as the industry’s highest-grossing quarter ever, according to the American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker. The revenue total marks a 4.1 percent increase over the industry’s pre-pandemic performance in Q1 2019 and is a 17.7 percent increase over Q1 2020, when the entire gaming industry shut down in March due to COVID-19.

Commercial gaming’s strong Q1 revenue numbers signify an accelerating recovery for the industry, with Q1 2021 revenue up 21.1 percent over Q4 2020. Gains in gaming revenue were largely driven by the industry’s performance in March, the highest-grossing revenue month in history for U.S. commercial gaming.

More than half of states with commercial casinos saw quarterly gaming revenue increases over Q1 2019, with several states reporting record quarters.

“Today’s report shows gaming’s comeback is ahead of schedule,” said AGA President and CEO Bill Miller. “Throughout the COVID-19 pandemic, our industry has faced numerous challenges head-on while still reopening responsibly and providing a safe, exciting environment for customers.”

Despite significant COVID-mandated restrictions on casino capacity and amenities across the country, traditional brick-and-mortar casino games generated 90 percent of their Q1 2019 revenue, with March 2021 revenue for slots and table games coming within one percent of March 2019 totals.

Sports betting revenue for Q1 2021 saw a quarterly U.S. record of $961 million, up 270 percent over Q1 2020 and surpassing 2019’s full-year total of $909 million. Boosted by the January launch of online casinos in Michigan, iGaming generated $784 million nationwide in Q1 2021, more than tripling U.S. iGaming revenue from Q1 2020.

“The gaming industry is generating these impressive results with one hand tied behind our back as capacity and amenity restrictions remain across the country,” said Miller. “This is a testament to gaming’s hard work to help ensure our team members’ safety and well-being, which enabled us to reopen safely. We applied those same standards to our customers, whose clear pent-up demand was met by our responsible industry.”

Background

- 30 states and the District of Columbia featured operational commercial gaming markets in Q1 2021, including casino gaming, sports betting and iGaming.

- By the end of Q1, 454 (97.8%) of 464 commercial casinos in the U.S. were open. While some states had returned to full capacity, most U.S. casinos were still operating with capacity restrictions ranging from 25-75%.

- COVID-related restrictions on casino capacity and amenities vary on a state and local level. AGA’s COVID-19 casino tracker is tracking casino capacity restrictions on a state-by-state basis.

About the AGA

The American Gaming Association is the premier national trade group representing the $261 billion U.S. casino industry, which supports 1.8 million jobs nationwide. AGA members include commercial and tribal casino operators, suppliers and other entities affiliated with the gaming industry. It is the mission of the AGA to achieve sound policies and regulations consistent with casino gaming’s modern appeal and vast economic contributions.