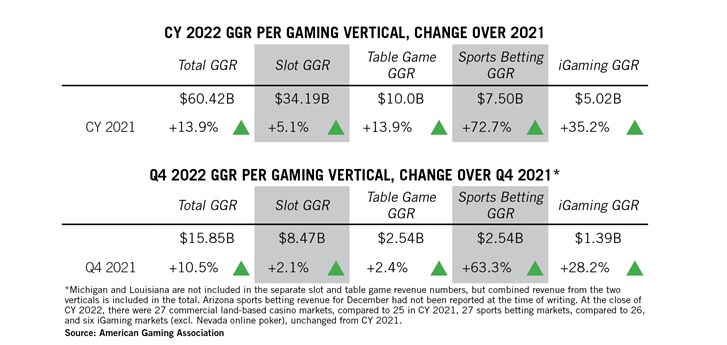

Washington, D.C. – U.S. commercial gaming revenue reached an annual record of $60.4 billion in 2022, according to the American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker. This marks the first $60 billion year for the commercial gaming sector, passing the previous record of $53.0 billion set in 2021.

The year was punctuated by all-time high quarterly commercial gaming revenue of nearly $15.9 billion in Q4 2022. Sports betting and iGaming both marked single quarter highs, while traditional gaming grew 1.7 percent year-over-year.

“Our industry significantly outpaced expectations in 2022,” said AGA President and CEO Bill Miller. “Simply put, American adults are choosing casino gaming for entertainment in record numbers, benefitting communities, and taking market share from the predatory, illegal marketplace.”

The industry continues to diversify offerings, with retail gaming accounting for 80.5 percent of total revenue and online gaming making up the remaining 19.5 percent—marking a new high. Looking at each sector:

- Traditional Gaming: 84 million American adults, or 34 percent of the adult population, visited a casino in the past year—including new markets in Nebraska and Virginia. Table game revenue experienced a strong boost in demand, up 13.9 percent year-over-year, while slot machines showed steady 5.1 percent annual growth.

- Legal Sports Betting: In 2022, the continued growth of the legal market drove new records for handle ($93.2B) and sportsbook revenue ($7.5B). This growth was fueled in part by Kansas, which operationalized both retail and mobile sports wagering, and the launch of mobile sports betting in Louisiana, Maryland and New York.

- iGaming: Online casino revenue grew 35.2 percent year-over-year to $5.0 billion in the limited number of legal iGaming states.

In 2022, the Las Vegas Strip and Atlantic City retained their top commercial market positions. The Baltimore-Washington, D.C. market reclaimed its position as the nation’s third largest gaming market, besting Chicagoland (fourth) and the Mississippi Gulf Coast (fifth) which round out the top five.

“Even as we navigate macroeconomic headwinds, I am optimistic about the year ahead,” continued Miller. “To carry our momentum into 2023, the AGA remains focused on combating the illegal market, doubling down on responsibility, and creating favorable policy and regulatory conditions that enable our industry’s sustained success.”

Background

- AGA’s Commercial Gaming Revenue Tracker provides state-by-state and cumulative insight into the U.S. commercial gaming industry’s financial performance based on state revenue reports. This issue highlights full-year 2022 figures and Q4 2022 results. Tribal gaming revenue is released annually by the National Indian Gaming Commission.

- 34 states and the District of Columbia featured operational commercial gaming markets in 2022, including casino gaming, sports betting and iGaming.

- AGA’s State of Play Map charts gaming’s economic impact, industry regulations and casino locations on a state-by-state basis for both the commercial and tribal gaming sectors.

About the AGA

As the national trade group representing the U.S. casino industry, the American Gaming Association (AGA) fosters a policy and business environment where legal, regulated gaming thrives. The AGA’s diverse membership of commercial and tribal casino operators, sports betting and iGaming companies, gaming suppliers, and more lead the $261 billion industry and support 1.8 million jobs across the country.

American Gaming Association, 799 9th St. NW Suite 700, Washington, DC 20001 United States