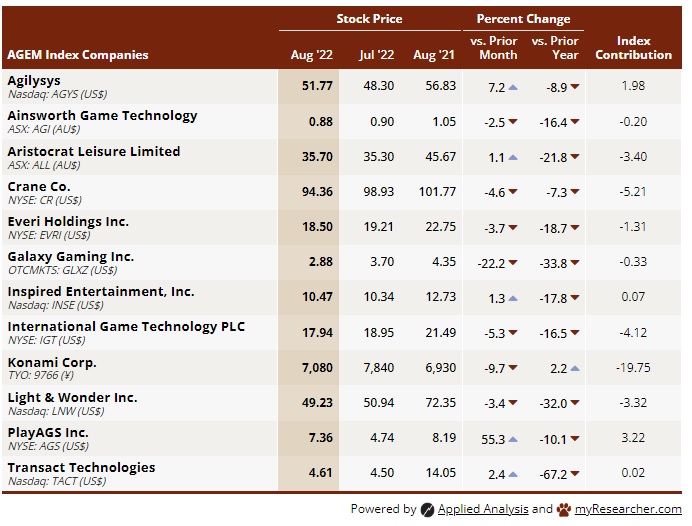

The AGEM Index fell by 32.33 points in August 2022 to 831.50, marking a 3.7 percent decline from the prior month.

Compared to one year ago, the index was down 181.38 points, or 17.9 percent. During the latest month, seven of the 12 AGEM Index companies reported stock price decreases, which resulted in eight negative contributions to the AGEM Index and four positive contributions.

The largest negative contributor to the monthly index was Konami Corp. (TYO: 9766), whose 9.7 percent decrease in stock price led to a 19.75-point loss to the index. Crane Co. (NYSE: CR) contributed a 5.21-point decline in the index due to a 4.6 percent decrease in its stock price. The largest positive contribution to the index was PlayAGS Inc. (NYSE: AGS), whose 55.3 percent increase in stock price equated to a 3.22-point gain for the AGEM Index.

All three major U.S. stock indices saw month-over-month decreases in August 2022, marking the second time this has occurred in the past three months. The Dow Jones Industrial Average fell by 4.1 percent from July, while the S&P 500 declined by 4.2 percent. Meanwhile, the NASDAQ fell 4.6 percent over the latest period.

The AGEM Index

The Association of Gaming Equipment Manufacturers (AGEM) produces the monthly AGEM Index that comprises 12 global gaming suppliers throughout the world. A total of nine suppliers are based in the United States and are listed on the NYSE, Nasdaq or OTC market, while two trade on the Australian exchange and one on the Tokyo exchange. The index is computed based on the month-end stock price (adjusted for dividends and splits) of each company and weighted based on approximation of market capitalization. Market capitalizations for manufacturers trading on foreign exchanges have been converted to US dollar-equivalents as of month-end for comparability purposes. The AGEM Index is based on a 100-point value as of January 2005. Company stock prices and AGEM Index contributions may be revised as necessary due to stock splits, reverse stock splits, mergers, acquisitions and other business activities.

.gif)