From its humble origins in Amersham, IFX Payments is growing into a force in the global payments sector. What once was a handful of staff has become a workforce of almost 200.

Vendors looking to tackle the problem of making mass payments to multiple clients in multiple currencies can find IFX to be a one-stop shop. To examine this phenomenon, Publisher Peter White recently sat down with Simon Hughes, sales director of 360 Sales at IFX Payments. Their ensuing conversation has been edited for clarity.

Let's begin by explaining your 'backstory' and how you got started in this industry.

After working in golf equipment sales until age 21, I entered real estate and met James Walton, IFX Payments' executive director of group operations. In 2008, I decided to leave real estate after James Walton offered me a role at IFX, where I joined as their seventh employee. I was initially based out of our Shardeloes Farm office in Amersham, which we have only recently vacated due to the growth of our operations team. Fifteen years on, I'm still with IFX and love every day. We have grown slightly from the days on the farm in 2008 — we now have around 170 staff (and growing).

What are the key benefits gained by customers from IFX Payments, an organization that has built its own FX and payments infrastructure?

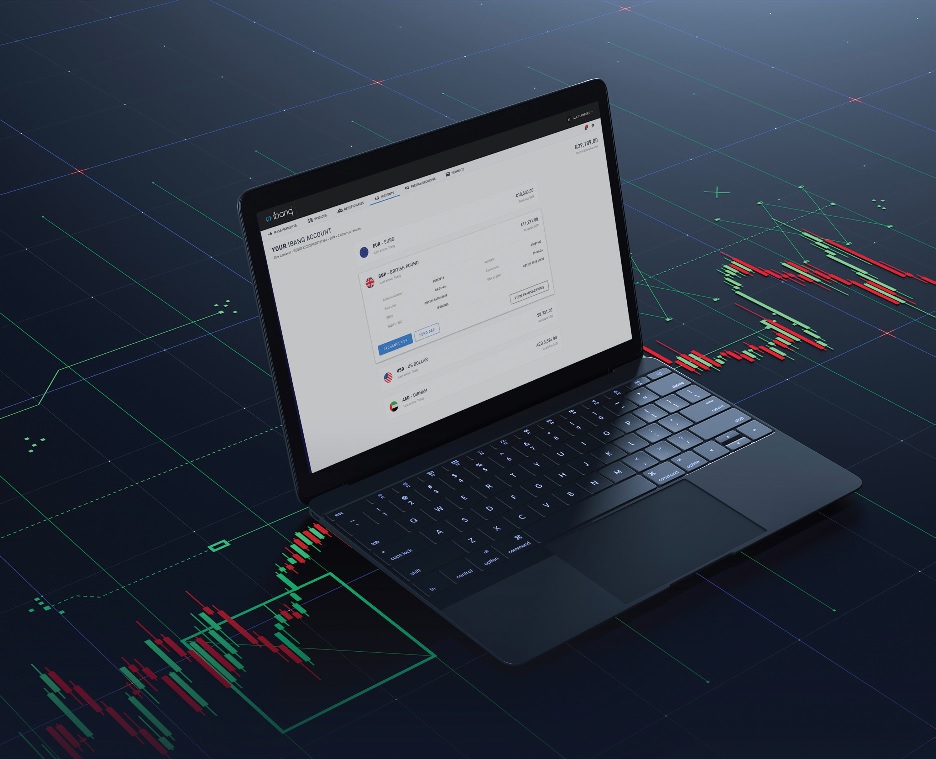

We have experienced account managers and support staff to ensure that our client journey is seamless. Having multiple liquidity providers gives us access to a wide range of currencies. ibanq, our multi-currency payments platform, was built in-house, which means we have full autonomy, and can scale and build it to suit our clients' needs. Having a mass-payments function accessible through our ibanq platform means clients can upload one file, and can make multiple payments in different currencies securely and quickly, so treasury teams save time, and money.

Client support is a vitally important provision. What is IFX Payments’ approach?

Businesses using our platform have access to a support team based in-house in the UK and a dedicated account manager with whom they have a relationship from the day they onboard. Our company has grown considerably since the launch of ibanq and we pride ourselves on our customer-support standards, ensuring we are positioned to promptly respond to any client queries. We understand the importance of our service to our clients and that it is vital to a business's ability to operate.

What payment services does IFX Payments provide?

Our platform, ibanq, gives businesses access to an all-in-one payments solution, facilitating instant, low-cost, and transparent payments in and out. Within ibanq we have two solutions: multi-currency accounts and mass payments. Our multi-currency accounts eradicate the need for businesses to own separate foreign currency accounts. With just one account, companies can send and receive funds in up to 38 currencies, and segregate those funds into individual currency wallets.

Our mass payments functionality does what it says on the tin. Through our international liquidity network, businesses have access to over 125 currencies, with which they can process international payments in bulk without opening local currency accounts. Payments through ibanq can be sent in several ways, including FPS, SEPA and SWIFT. ibanq can provide spot rates, giving users the options to book trades at pre-agreed margins. We're also able to offer forward contracts and limit orders/stop losses to help mitigate clients' currency exposure via our phone-brokerage service.

In your opinion, what are the most important factors CFOs at online and land-based gaming operators should consider when looking to expand their organization's digital payment capabilities?

One of the most important factors is the jurisdiction that the operator is servicing. Some jurisdictions may appear lucrative on paper; however, there may be limited payment provider options to meet the operator’s needs. We work with various industry verticals, including the gaming sector, and understand the issues that our clients face. As we work with a range of banking partners, we are well-positioned to help businesses find solutions in their chosen jurisdictions.

Based on your vantage point as an insider in the finance industry, what innovations should the gaming sector expect to see in payments in the short and medium term?

Open banking is the one that stands out. With an open-banking solution in place, payment providers can help the retailer/service provider get paid faster with lower merchant fees. This lets customers pay directly through their bank account when purchasing or depositing. Service providers can then be paid within minutes compared to a debit card transaction, which may take a few days, and there is also minimized risk of the dreaded ‘chargeback.’

What are the key reasons that have made IFX Payments a good partner to the online and land-based gaming sector?

There are a few reasons, but the main one is our support team. Our skilled team have excellent relationships with our clients and banking partners so that any problems can be resolved quickly. Aside from this, our ibanq platform is user-friendly. It also includes features such as automatic proof of payment to the beneficiary and validates beneficiary bank details when mass payment files are uploaded, ensuring errors in bank details are kept to a minimum and gives our clients confidence.

What is the most frequently asked question you are asked by online and land-based gaming operators?

Many companies ask us which gaming licenses we can service. We service gaming clients who are licensed in the UK and also some overseas gaming clients on a limited basis. We are currently looking at strategic options to expand our offering to more territories.

You are a London-based payment operator. Who are your main regulators?

In the UK, we are regulated by the Financial Conduct Authority as an Electronic Money Institution. We are also registered as a Foreign Money Services with FINTRAC in Canada, and we have permission to market our services as a Representative Office in the Dubai International Financial Centre. https://www.ifxpayments.com/

.gif)